RedBlock研究院 | 比特币普尔倍数与稳定币供应比率

Author: Joel Ochoa

RedBlock would like to thank Cryptoquant.com for their support in providing us with real time on-chain and market data.

感谢Cryptoquant.com为本报告提供实时链上与数据支持

Bitcoin Puell Multiple 比特币普尔倍数

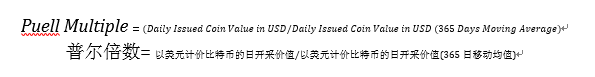

The Bitcoin Puell Multiple represents the ratio of the daily value of the issued coin in USD divided by the 365 days moving average of the daily value of issued coins in USD. According to Cryptoquant, Puell Multiple can be interpreted as an answer to the question, "if all mined bitcoins were sold immediately in the market, how profitable [are] mining pools… compared to the last historical one year?". This metric predicts market cycles, which helps traders to take long positions. The formula is represented below:

比特币普尔倍数表示以美元计价比特币的日开采价值与该指标365日移动均值之比。据Cryptoquant的说法,普尔倍数可用于解答以下问题:“如果所有比特币一经开采便立即在市场上出售,那么与上一年相比,比特币矿池的利润究竟能有多高?” 该指标可以用于预测市场周期,从而帮助交易员建立多头头寸。

普尔倍数的计算公式如下:

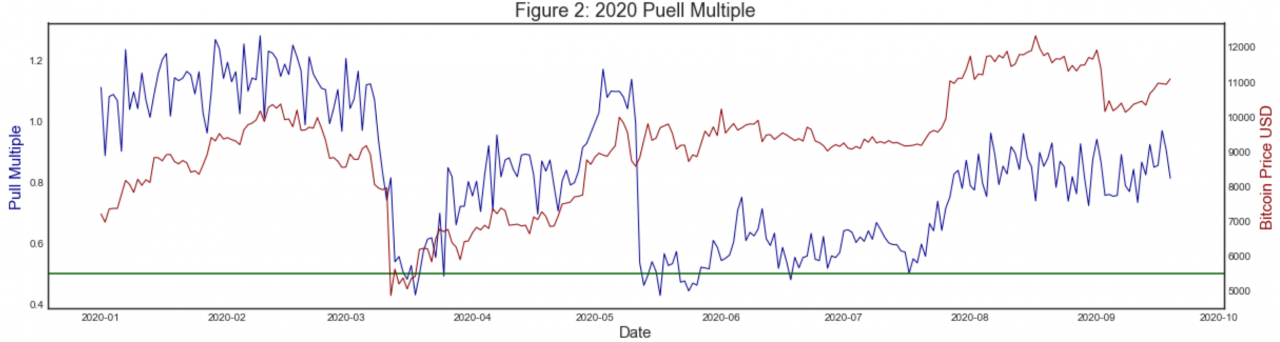

We set the upper threshold as 4 and the lower threshold as 0.5 for spotting market tops and bottoms. The red line indicates strong sell, while the green line indicates a strong buy.

为观察市场的顶部和底部,我们将上限设为4,下限设为0.5。红线表示强劲卖出,而绿线表示强劲买入。

As shown in Figure 1, the Puell Multiple finds Bitcoin’s local tops or bottoms. The use of the Puell Multiple indicator may have helped investors to prevent the 2017 Bitcoin crash since the indicators passed the upper threshold during the crash in mid-December of 2017. During that crash, Bitcoin’s price plummeted 84% from the record high of nearly $20,000 to record lows around $3,200 in mid-December 2018, with the Puell Multiple hitting a low of 0.30.

如图一所示,普尔倍数找到了比特币的头部和底部。普尔倍数指标在2017年12月中旬比特币崩盘期间超过了上限,因此很有可能帮助投资者有效阻止了此次崩盘。在那次崩盘中,比特币价格从近2万美元的历史高点暴跌84%,跌至2018年12月中旬约3200美元的历史低点,普尔倍数则跌至0.30的低点。

According to Figure 2, 2020 has been a positive year for Bitcoin. The Puell Multiple slipped to 0.41 on March 16 and on May 14, it fell to the lowest level since January 17, 2019. Also, the indicator has been stable from 0.41 to 1.3 throughout the year. Before Bitcoin broke the $10,000 barrier in June 2020, the Puell Multiple was located at the 0.40 level.

图二显示,2020年是比特币发展利好年。普尔倍数于3月16日跌至0.41并于5月14日降至2019年1月17日以来的历史最低水平。此外,该指标全年稳定在0.41至1.3之间。在比特币于2020年6月突破1万美元大关之前,普尔倍数位于0.40的水平。

Stablecoin Supply Ratio 稳定币供应比率

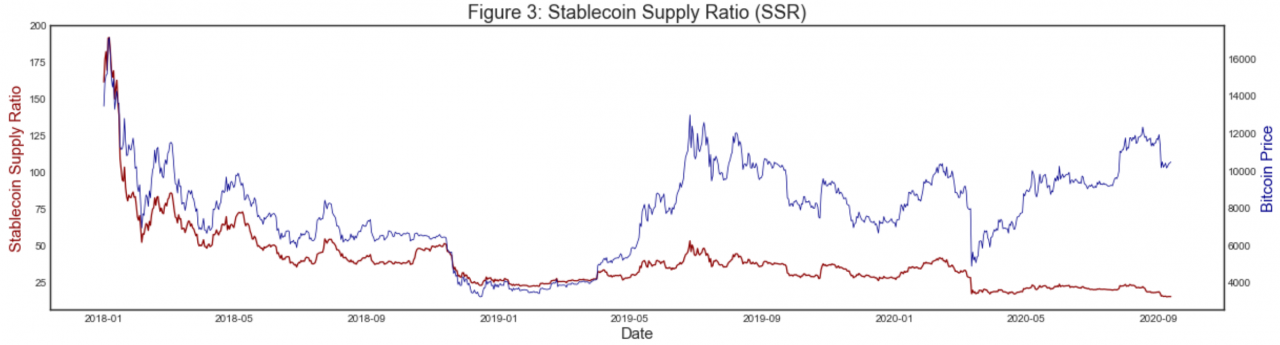

Stablecoins are an important part of the cryptocurrency market as a fiat currency like the USD in the regulated market. The stablecoin supply ratio (SSR) represents the ratio between the injection of capital in Bitcoin and the capital flowing into stablecoins. For example, a low Bitcoin price allows stablecoin owners to purchase more of the BTC supply in exchanges. The more the supply in stablecoin markets, the more the potential buying pressure for major cryptocurrencies like BTC and ETH. On the other hand, less supply in stablecoin markets may indicate a slowdown in buying pressure, which may result in potential bearish moments.

稳定币是加密货币市场的重要组成部分,其地位等同于美元等法币在合规市场中的重要地位。稳定币供应比率 (SSR)表示注入比特币的资金与流入稳定币的资金比率。例如,当比特币价格较低时,稳定币所有者便会通过交易所购进更多的比特币。随着稳定币市场的供应量增大,主流加密货币(如BTC和ETH)的潜在购买压力也会随之上升。相反,稳定比市场供应量的减少则预示着购买压力的下降,这可能会导致潜在的熊市来临。

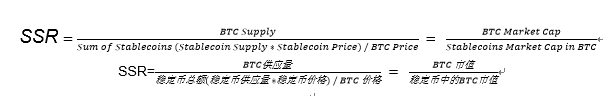

As shown in Figure 3, if SSR is low, it means that there may be a potential bullish sentiment, and if the value is high, there may be a bearish sentiment. The formula is represented below:

如图三所示,若SSR值较低,则意味着可能存在潜在的看涨情绪;反之,若SSR值较高,则可能存在看跌情绪。

SSR计算公式如下:

After Bitcoin’s plummet of 62%, from $10,236 to $3,868 in March 2020, Bitcoin’s Stablecoin Supply Ratio has been stable in its all-time low. Since the 2020 data for SSR has been inaccurate with the recent increases of Bitcoin’s price in March and July of 2020, it is unclear how this indicator will play out at the end of 2020 and beyond.

2020年3月,比特币价格从10236美元暴跌至3868美元,跌幅达62%。此后,比特币的稳定币供应比率一直稳定在历史低点。鉴于2020年SSR的数据与最近2020年3月和7月比特币价格的上涨关系并不明确,因此尚不清楚该指标在2020年底及之后将发挥何种作用。

Source: Data collected from CryptoQuant and Bitstamp exchange website.

资料及数据来源:数据援引自CryptoQuant和Bitstamp交易所网站。

- 免责声明

- 世链财经作为开放的信息发布平台,所有资讯仅代表作者个人观点,与世链财经无关。如文章、图片、音频或视频出现侵权、违规及其他不当言论,请提供相关材料,发送到:2785592653@qq.com。

- 风险提示:本站所提供的资讯不代表任何投资暗示。投资有风险,入市须谨慎。

- 世链粉丝群:提供最新热点新闻,空投糖果、红包等福利,微信:msy2134。

通讯周刊

通讯周刊